Cryptocurrency adoption in developing countries: a game changer

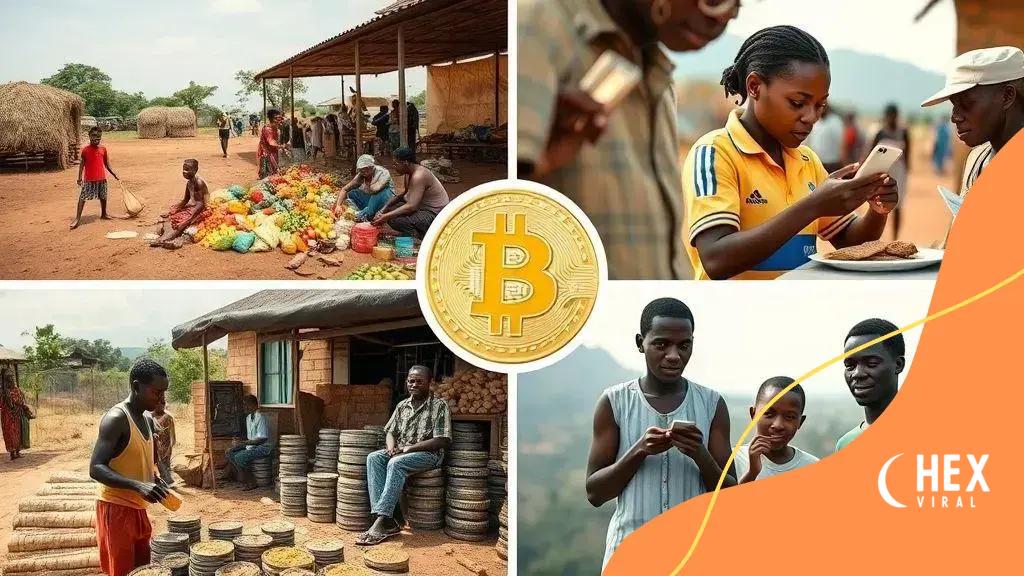

Cryptocurrency adoption in developing countries enhances financial inclusion, reduces transaction costs, and paves the way for economic growth by allowing direct access to global markets.

Cryptocurrency adoption in developing countries is more than a trend; it’s reshaping the financial landscape. Have you considered how this digital revolution might affect everyday lives and economies? Let’s dive in.

The impact of cryptocurrency on developing economies

The impact of cryptocurrency on developing economies is profound. As more individuals in these regions adopt digital currencies, the entire financial landscape is changing. With lower transaction fees and faster payments, cryptocurrency provides an alternative that traditional banking often doesn’t offer.

By enabling access to global markets, these digital assets allow entrepreneurs to expand their businesses beyond borders. For small business owners in developing countries, even a small increase in sales can lead to significant growth.

Benefits of Cryptocurrency

Cryptocurrency brings several advantages that can benefit emerging markets:

- Financial inclusivity: Many people in developing countries lack access to traditional banking.

- Lower fees: Transactions with cryptocurrencies typically involve lower costs compared to banks.

- Security: The decentralized nature of blockchain technology enhances security and reduces risks of fraud.

- Fast transactions: Sending money internationally is quicker with crypto than traditional methods.

However, with these advantages come challenges that must be addressed. Infrastructure in many developing countries may not support the widespread adoption of digital currencies. Without adequate internet access, for instance, the benefits of cryptocurrency remain out of reach for many.

Furthermore, fluctuating values pose another challenge for users relying on cryptocurrencies for stability in their financial dealings. It’s crucial for individuals and businesses to be educated about the volatility of crypto and to ensure they manage their investments wisely.

Impact on Local Economies

As communities begin to adopt cryptocurrency, we see tangible results in local economies. For instance, trade increases as merchants accept digital currencies, leading to more dynamic commercial environments. The ability to transact globally also opens doors to international investment opportunities.

Moreover, cryptocurrencies often foster innovation. Local tech companies and startups can leverage blockchain technology to solve unique challenges faced by their communities. This not only stimulates growth but can create jobs, further uplifting the local economy.

Challenges faced in cryptocurrency adoption

The challenges faced in cryptocurrency adoption are significant, especially in developing countries. Many potential users lack sufficient knowledge or understanding of how these digital currencies work. This gap can lead to hesitancy and mistrust among individuals considering using cryptocurrency.

Another major challenge is regulatory hurdles. Governments in many regions are still figuring out how to regulate digital currencies effectively. This uncertainty can stifle innovation and discourage investment in cryptocurrency-related projects.

Infrastructure Issues

In addition to educational barriers, infrastructure limitations play a critical role. Access to reliable internet and electricity is inconsistent in many developing countries. This lack of basic infrastructure can make it difficult for users to engage with cryptocurrency networks.

- Poor internet connectivity: Many rural areas lack reliable internet access, making it hard to transact digitally.

- Electricity shortages: Frequent power outages hinder the ability to mine or use cryptocurrencies.

- Limited device availability: Not everyone has access to smartphones or computers necessary for crypto transactions.

Security concerns also arise with cryptocurrency adoption. Many individuals worry about the safety of their investments in an environment rife with scams and fraud. As digital currencies become more popular, the risk of phishing attacks and hacking increases.

Moreover, the volatility of cryptocurrency prices can deter potential users. For those in developing economies, even a small fluctuation in value can significantly impact their financial situation. This uncertainty makes it challenging for people to rely on digital currencies as a stable form of money.

Cultural Barriers

Cultural attitudes toward technology can influence cryptocurrency adoption as well. In certain societies, traditional banking practices are deeply rooted, and the shift to digital currencies may be met with skepticism or resistance. Educating communities about the benefits and uses of cryptocurrency can take time and effort.

While many challenges exist, the potential benefits of adopting cryptocurrency in developing countries remain significant. Overcoming these hurdles can open new doors for economic growth and financial inclusion.

Successful case studies of cryptocurrency in action

Successful case studies of cryptocurrency in action illustrate its potential to transform lives and economies. In various developing countries, we see real-world examples of how digital currencies can bring positive changes.

One notable case is in Kenya, where a mobile money service, M-Pesa, has revolutionized financial transactions. Although it is not solely a cryptocurrency, it has paved the way for greater acceptance of digital transactions. M-Pesa has enabled millions to perform transactions easily, increasing financial inclusion.

Case Study: El Salvador

Another significant example is El Salvador, which became the first country to adopt Bitcoin as legal tender. This bold move aims to improve financial access for many citizens. By using Bitcoin, people can send remittances cheaper and faster, benefiting the economy.

- Increased remittances: Since adopting Bitcoin, the country has seen a surge in remittances, leading to more money flow into local economies.

- Financial education: The government is also investing in education to help citizens understand how to use Bitcoin safely.

- Attracting investment: The move has attracted global interest, creating new investment opportunities.

In Nigeria, cryptocurrency has gained popularity among the youth. Many young people are trading digital currencies as a way to earn income. With large populations facing high unemployment rates, crypto trading offers a source of income and potential financial freedom. Platforms like Binance and P2P exchanges have made it easier for them to trade.

Case Study: South Africa

In South Africa, businesses are starting to accept cryptocurrency for payments. Companies like Takealot have begun allowing customers to pay with Bitcoin. This shift demonstrates growing confidence in digital currencies.

Furthermore, innovation hubs in cities like Cape Town are fostering blockchain startups. This encourages technological advancement as local entrepreneurs find ways to leverage cryptocurrencies to address social issues.

As these case studies show, the successful implementation of cryptocurrency has the potential to drive economic growth and improve lives in developing countries. Each example offers insights into overcoming challenges and maximizing opportunities presented by digital currencies.

The role of government regulations

The role of government regulations in cryptocurrency adoption is crucial, especially in developing countries. These regulations can either facilitate or hinder the growth of digital currencies. Understanding how governments respond to cryptocurrencies can help us see the bigger picture.

Many governments are still figuring out how to regulate digital currencies effectively. In some cases, regulations can promote growth by providing a legal framework for businesses and investors. Without clear guidelines, many companies may be hesitant to innovate or invest in the cryptocurrency sector.

Positive Effects of Regulation

When government regulations are supportive, they can lead to several positive outcomes:

- Legal clarity: Regulations can establish clear guidelines for cryptocurrency use, making it easier for businesses to operate.

- Consumer protection: Regulations can help protect individuals from scams and fraudulent activities in the cryptocurrency market.

- Increased trust: A regulated environment can build trust among users, encouraging more people to adopt cryptocurrencies.

- Investment growth: Clear regulations can attract foreign investments into a country’s cryptocurrency market.

In contrast, overly strict regulations can stifle innovation. For example, high taxation on crypto transactions might deter individuals from engaging in digital currency trading. If regulations become too burdensome, startups may struggle to thrive or emerge.

Examples of Regulatory Approaches

Different countries have taken varied approaches to cryptocurrency regulation. For instance, China has imposed severe restrictions on cryptocurrency trading and Initial Coin Offerings (ICOs). While this has limited trading, it has also pushed innovation towards the development of state-backed digital currencies.

On the other hand, Malta has embraced cryptocurrency, attracting numerous blockchain businesses. The Maltese government created favorable laws, positioning the country as a “blockchain island.” This proactive approach has drawn investment and innovation.

In the United States, regulatory bodies like the SEC and IRS have begun to develop frameworks to address cryptocurrency. This helps in fostering an environment where cryptocurrencies can flourish alongside traditional financial systems.

Ultimately, the balance between regulation and innovation is delicate. As governments worldwide decide on their stance towards cryptocurrency, the path they choose will shape the future landscape of digital currencies.

Future trends in cryptocurrency adoption

The future trends in cryptocurrency adoption are promising and suggest a growing influence on global economics. As technology advances, many aspects of life will likely begin integrating digital currencies. This transformation could reshape how we think about money, transactions, and the global economy.

One trend to watch is the increasing mainstream acceptance of cryptocurrencies. More businesses are starting to accept digital currencies as payment. Large companies like Tesla and PayPal have shown interest, paving the way for others. As major retailers follow suit, everyday consumers may find it easier to use cryptocurrencies for their purchases.

Integration with Financial Services

The integration of cryptocurrencies with traditional financial services is another key trend. Banks are beginning to explore offering services like crypto trading and storage. This will help legitimize digital currencies in the eyes of the general public, allowing more individuals to participate in the market.

- Crypto savings accounts: Some financial institutions are starting to offer savings accounts that yield interest on crypto holdings.

- Blockchain technology: Continued advancements in blockchain will enhance security and create new opportunities for decentralized finance (DeFi).

- Investment products: Financial products linked to cryptocurrency, such as ETFs (exchange-traded funds), are also gaining traction.

Alongside these advancements, we can expect to see heightened government interest in regulation. To facilitate the growth of the cryptocurrency market, clear regulations will become increasingly important. Governments will likely work to strike a balance between encouraging innovation and protecting consumers.

Emerging Technologies

Emerging technologies such as artificial intelligence (AI) and the Internet of Things (IoT) will also impact cryptocurrency adoption. For instance, smart contracts utilizing blockchain technology can streamline various processes in industries like real estate and supply chain. These innovations can significantly reduce costs and enhance efficiency.

As awareness and acceptance grow, educational efforts will become essential. Many individuals still lack a clear understanding of cryptocurrencies. Educational initiatives will help demystify this technology and provide users with the knowledge they need to engage safely and effectively.

Overall, the future of cryptocurrency adoption holds great promise. With ongoing technological advancements, regulatory clarifications, and rising popularity, we may soon see digital currencies play a central role in everyday transactions.

In conclusion, the future of cryptocurrency adoption is bright, especially in developing countries. As technology continues to evolve, we will see cryptocurrencies become a more integral part of everyday life. Governments are beginning to recognize the need for clear regulations that can both protect users and facilitate innovation. The integration of cryptocurrency with traditional financial services will likely enhance trust and usage. As individuals and businesses become more aware of the benefits, the adoption of digital currencies will continue to grow. Overall, the landscape of cryptocurrency is rapidly changing and offers significant potential for economic development.

FAQ – Frequently Asked Questions about Cryptocurrency Adoption

What is cryptocurrency adoption?

Cryptocurrency adoption is the process of individuals and businesses starting to use digital currencies for transactions, investments, and other financial activities.

How can cryptocurrency benefit developing countries?

Cryptocurrency can increase financial inclusion, reduce transaction costs, and provide access to global markets for businesses in developing countries.

What challenges do countries face in regulating cryptocurrency?

Countries face challenges such as creating clear guidelines, preventing fraud, and addressing the volatility of cryptocurrencies while still encouraging innovation.

What trends should we expect in the future of cryptocurrency?

Future trends include increased mainstream acceptance, better integration with financial services, and more educational initiatives to inform users about digital currencies.